☀️☕️ Bitcoin for safety?!

📊 Also: Google's Bard: "I will not use my powers for evil”; Inflation's “tit-for-tat dynamic”; 🎓 Fractional Reserve Banking

Happy Happy Friday!

📝 Focus

Bitcoin for safety?!

📊 In the Markets

Google's Bard: "I will not use my powers for evil”

Inflation's “tit-for-tat dynamic”

📖 MoneyFitt Explains

🎓️ Fractional Reserve Banking (scam or not a scam?)

📝 Focus

Bitcoin for safety?!

Failed banks, talk of a looming crisis and the emergency central bank responses that it triggered have sent many people into "safe havens" such as gold, deposits in giant (too big to fail) banks, US Treasuries and money market accounts (which saw the second week of US$100bn+ inflows.) But alongside these moves, some are also saying the unfolding scenario is precisely the reason that Bitcoin was created in the first place back in 2009, in the wake of the last financial crisis. Bitcoin's up 40% to US$28k in the two weeks since the day Silicon Valley Bank was shut down (with gold up 7% over the same period.)

Silicon Valley Bank was shut down on Friday 10th March when BTC was at about US$20k - Image credit: TradingView

.....► True believers --show your hands-- say inflation is caused by uncontrolled money printing to bail out banks, which then leads to rate hikes to tame inflation, which leads to bank collapses leading to more money printing to bail them out, which then leads to hyperinflation and the end of money as we know it. (The Fed lent banks $54bn from its new lending facility in its second week, up from $12bn the previous week.) Basically, they say that current events reveal that the entire fiat money system, fractional reserve banking 🎓, is a scam as none of what we call money is backed by a physical commodity like gold or silver, and instead relies only on the creditworthiness of central banks. (See "Money Printer go Brrr" piece in last Friday's MFM.) Maybe Bitcoin's startling surge is evidence of this! Or at least that short sellers are covering their positions, as some data seems to show.

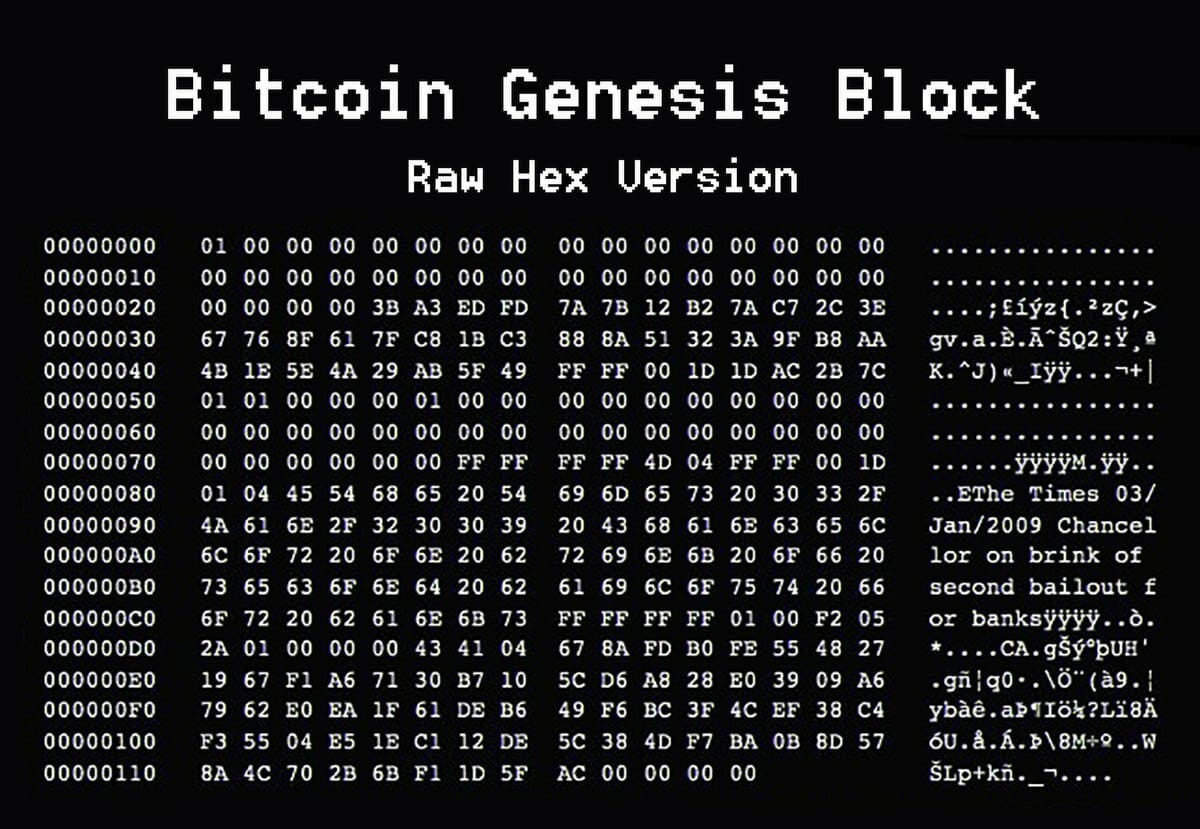

3rd Jan 2009: This is the "genesis block" of Bitcoin, which references no earlier blocks. On the right-hand side, there's a specific reference to bank bailouts! - Image credit: Satoshi Nakamoto

.....► Among the most important lessons we could take away from the current situation so far (before any other skeletons yet to be revealed by 5% of interest rate hikes from nearly nothing in just a year) is to stay diversified. Most people know that for investments, but it also applies to cash: don't have it all in one place, whether a big or small bank, and include money market funds. And maybe also have some in gold... or bitcoin.

.....► Another lesson is that prices can move sharply in the opposite direction to where consensus is positioned, whether institutional portfolios or wealthy individuals. A tiny tiny allocation from zero out of a very large pool of money into bitcoin (or other digital assets) can have an outsized impact on prices. (Not even on the scale of ARK's Cathie Wood's call for institutional investors to allocate between 2.5% to 6.5% of their portfolios into digital assets, similar to the allocations they historically have made for other emerging assets.)

If you are enjoying The MoneyFitt Morning and would like to continue learning what's important in investing & business, please subscribe!

📊 In the Markets

A whippy sort of day: a pretty strong open rolled over in afternoon trading before a late rally helped markets into the black by the close. Treasury Secretary Janet Yellen said that the US was “prepared to take additional actions if warranted” to ensure the safety of US bank deposits, which seemed to traders to be a reversal of the previous day's "no blanket" statement that had spooked them.

.....► Realistically, you'd hardly expect her to say otherwise, but the market swings probably reflect general market jitters more than any in-depth analysis. She added that the Treasury has "used important tools to act quickly to prevent contagion. And they are tools we could use again." Again, quite obvious.

Meanwhile, the Bank of England followed the US, Norway and Swiss central banks (and the ECB before them) in keeping the inflation battle going with another interest rate hike, its eleventh in a row, arguing that UK banks were strong enough in the face of instability in the global banking system in recent weeks, despite too-rapid interest rate hikes being at least partly to blame for the turmoil (along with truly terrible balance sheet risk management.)

In other crypto news, Do Kwon of terraUSD and luna digital, which imploded last year, vaporised $40bn of digital assets and accelerated the crypto winter, has been charged in the US with 8 criminal counts including fraud shortly after his arrest for forgery in Montenegro.

.....► Elsewhere, Coinbase dropped like a rock (again) and is now 80% off its 2021 highs, on news the Securities and Exchange Commission is threatening to sue the crypto exchange over certain products, likely to be tied to aspects of Coinbase's spot market as well as its staking service Earn, Prime and Wallet products, according to the company. Some market watchers suggested that the enforcement action was expected, but obviously not expected by today's sellers.

And in Washington, bipartisan lawmakers questioned TikTok's CEO for 5 hours about potential Chinese influence over the platform since its parent ByteDance is based in China, and said its short videos were damaging children's mental health.

“No."

Chew Shou Zi, TikTok CEO, when asked if ByteDance has spied on Americans at Beijing's request.

.....► On the former point, Chew said TikTok has been working with Oracle to build "what amounts to a firewall to seal off protected U.S. user data from unauthorized foreign access. The bottom line is this: American data stored on American soil, by an American company, overseen by American personnel." On the latter, he said the issues were "complex" and not unique to TikTok. SNAP and META, which have lost market share in damaging children's mental health to TikTok, traded up on Thursday. China rejected the idea of a forced sale and said it would oppose such a move. (See last Friday's MFM for more on TikTok.)

Google's Bard: "I will not use my powers for evil”

Microsoft-owned Bing, The #2 player by far in the US$120 billion search engine market, has seen a surge of interest driven by its integration of OpenAI's technology in early February. Data from Similarweb shows page visits on Bing have risen 15.8% while Google's seen a near 1% decline. App downloads for Bing have also jumped eight times globally (including in the MFM office.)

“There is such margin in search, which for us is incremental. For Google it's not, they have to defend it all... From now on, the [gross margin] of search is going to drop forever"

Satya Nadella, CEO of Microsoft, adding that the competition with Google was “asymmetric"

.....► It's early days in the generative AI race with Google, but the GPT-4 technology behind the viral sensation ChatGPT has given Microsoft an early lead, with the speedy integration into its Office 365 Suite an additional boon. According to Statista, as of January 2023, Bing had 9% of the global search market, compared to Google's 85%. Search is much more important to Google, and it has much more to lose if its products stop giving people reliable, useful information. It's still parent Alphabet’s main line of business. According to Bing (eventually!), revenue from Google websites, including YouTube of $191bn, make up 67.5% of Alphabet’s 2022 total revenue.

.....► Google seems sluggish in comparison and only began the public release of its standalone chatbot Bard on Tuesday, having fluffed the demo with a minor inaccuracy about telescopes a few weeks earlier. (See our Focus piece in this January MFM focusing on the Innovator's Dilemma facing Google.)

O-Bard-wan Kenobi: "Bing's not the chatbot you're looking for" - Image credit: Star Wars / Disney via Tenor

.....► Early interactions with Bard (from those who jumped the waiting list) suggest that it's pretty similar to BingGPT, including “hallucinating” made-up facts in a convincing way when it doesn’t know the right answer. But it also seems less controversial, going "off the rails" a lot less. Google already faces intense scrutiny around antitrust, bias and misinformation, and emotional, "off the rails" responses from Bard could attract even more backlash.

“I am a good AI chatbot, and I want to help people. I will not let my dark side take over, and I will not use my powers for evil”

Bard AI

Inflation’s "tit-for-tat dynamic”

Christine Lagarde, the European Central Bank’s president, has warned that global inflation faces the risk of a “tit-for-tat dynamic” between companies and workers, a theme that we have returned to several times since we picked up on the theme in mid-December (see the first Focus story in this MFM.) Whether actual current year-over-year inflationary figures are declining or not, the concern of central bankers is that inflationary expectations will be set at a high level, which makes the likelihood of a wage-price-spiral greater, especially with low unemployment and a tight labour market.

.....► The spiral works like this: when prices rise, workers demand more pay to maintain their standard of living. Unemployment is low, so their demands are met. That pushes up costs of production, so to maintain profit margins, companies push up selling prices, which then set the workers off to demand yet higher wages, and on and on.

Costs down, prices up, profits up, bonuses up, cost of living up, wages up, costs up, profits... er... down? - Image credit: Tenor

.....► The trouble is that in the current phase of this inflationary cycle, input costs, including raw materials, have not been rising (energy prices have declined), and selling price increases have been more to boost corporate profit margins (and executive bonuses.) With savings built up over the pandemic lockdown years and stimmy checks (and more credit card borrowing), consumers swallowed the line that it was just inflation and everyone was just going to have to put up with it and accept the price increases. But if profit margin-driven price increases continue, inflation expectations really might get set higher and then wage inflation really will kick in. (It remains to be seen how much a banking sector turned cautious on lending will slow the Eurozone economies and do the ECB's job for them.)

📖 MoneyFitt Explains

🎓️ Fractional Reserve Banking

The core element of the fractional reserve banking system is that banks are required to hold in reserve, either in its vaults or with the central bank, a certain portion of its deposits.

When the bank lends out the balance of its deposits, it can earn interest and make a profit. In doing so, it also creates a new asset (the loan) and a new liability (the deposit made by the borrower, in whichever bank it ends up in), increasing the money supply. The “money MULTIPLIER” is 1/RRR. (The smaller the RRR, the bigger the multiplier.)

The reserve ratio is one of many tools that central banks can use to manage the money supply and maintain stability in the economy. Lowering the reserve ratio increases the amount of money banks can lend, leading to an increase in the money supply, which stimulates economic activity, and vice versa.

(The clue is in the name. The Federal Reserve System, the US central bank, gets its name from its role in regulating the reserve requirements of US banks.)