☀️☕️ The Country Garden Card

📊 Also: Sam Bankman-Jailed; Good is Bad in the UK; Gimme CPI Shelter 🎓 Are you Insolvent or Bankrupt?

Happy Monday!

📈 Market Roundup 14-August-2023

US large-cap S&P 500 closed 0.11% DOWN 🔻

Tech-heavy Nasdaq Composite closed 0.68% DOWN 🔻

Pan European STOXX Europe 600 closed 1.09% DOWN 🔻

HK/China's Hang Seng Index closed 0.9% DOWN 🔻

Japan's broad TOPIX closed 0.92% UP ▲

📝 Focus

The Country Garden Card

📊 In the Markets

Sam Bankman-Jailed

Good is Bad in the UK

Gimme CPI Shelter

📖 MoneyFitt Explains

🎓 Are you Insolvent or Bankrupt?

Our Community is Now 3000+ Strong! 🚀

Help us grow further by sharing your referral link with someone you think would benefit from our newsletter: {{rp_refer_url}}

Thank you! 😊

You can also help our friends grow by visiting our recommendations here.

📝 Focus

The Country Garden Card

On Saturday, Country Garden said in filings to the Shenzhen Stock Exchange that it will suspend trading in eleven onshore bonds starting Monday. In our China deflation piece just last Thursday, we noted that Country Garden, China's top property developer by 2022 sales and (until recently) with a reputation as a stable player in a turbulent sector, missed interest payments on two international bonds. On Friday, the firm announced that it expected a first-half loss of up to $7.6bn, highlighting the severity of China's property crisis and causing the HK-traded shares to fall 6% for the second day running to a new low of under HK$1, making it a 31% drop for the week and taking its decline since its early 2018 peak to 94%.

..... ▷ What we didn't mention on Thursday was that the missed coupon payments only came to US$22.5 million, a tiny figure relative to its total liabilities at end-2022 of $194bn (including $10bn in US Dollar bonds.) And it couldn't come up with it. The company has 30 days to make the payment, or it would be in breach of the terms of the bonds (i.e. in default), which does not automatically mean the firm is insolvent or bankrupt🎓, but certainly moves the ball along in that direction. While Yang Huiyan, the major shareholder, may be able to fill up the coffers just enough by then, Bloomberg estimates that Country Garden faces $2.9bn in bond repayments by the end of the year. Given Country Garden's focus on third- and fourth-tier cities and 3,000 unfinished/ongoing projects, the breadth of the fallout among ordinary Chinese citizens could potentially be greater than that of Chinese real estate default poster child Evergrande, the world's most indebted company with some $310bn in liabilities (and just 1,300 outstanding projects.)

If you look closely, one of those says Evergrande. Is Country Garden also there?

- Image credit: Tenor

..... ▷ Country Garden's liquidity pressures comes from the collapse of usable cash thanks to underperforming contracted sales, down 60% in July, and a worsening refinancing environment. The real estate sector once propelled China's urbanisation and economic growth, starting from the housing reform of 1998, which ended the free distribution of housing by employers and established a housing finance system. Estimates of the size and impact of China’s real estate sector vary, but it's likely about 20-30% of the economy. Property developers presell apartments off-plan and, with additional bank borrowing, use the money to buy more land to develop and presell more apartments (which some say is "Ponzi-like.") But when lending was cut by the central government, developers had no money to finish the homes they had sold, leading to enormous debt repayment problems or bankruptcy for developers. Unfortunately, buyers who had only ever seen prices rise saw savings wiped out, and last year, many staged unprecedented "mortgage strikes" in protest. Estimates suggest 2 million unfinished homes that have been pre-sold. Developers have been offering incentives like mobile phones, gold bars and even new cars in order to move stock and get some cash flowing in, apparently to no avail.

..... ▷ Also on Friday, news emerged that Chinese trust company Zhongrong International Trust had delayed payments of maturing wealth management products (WMP). This is leading to speculation over the health of major shareholder Zhongzhi Enterprise Group (ZEG), which has about a trillion yuan in assets under management, according to Beijing-based financial and investigative news outlet Caixin. The connection is that Chinese WMPs, which typically offer a fixed rate of return of 3% to 5% over a short period, usually of less than six months (compared with 1.5% for one-year bank deposits), have become increasingly exposed to the real estate sector, either through buying bonds or lending directly to developers or projects. Zhongrong is said to be particularly exposed to real estate debt (Sunac, Evergrande, Fantasia, Fortune Land etc.) Almost all major private developers offered WMPs as a way to raise capital after the government tightened access to traditional bank loans for them at the end of 2020. The WSJ recently reported that many of China's 200 million retail stock market investors have fled volatile local markets in favour of safer CDs and insurance company products known as investment-linked policies (ILPs)... which have also invested heavily in trust company WMPs, providing riskier exposure than they might have expected.

How many were sold?

- Image credit: Alexandra Koch via Pixabay

📊 In the Markets

The S&P 500 and Nasdaq fell, marking a second week of losses due to higher U.S. producer prices boosting Treasury yields and affecting rate-sensitive mega-cap growth stocks. US producer prices increased by 0.8% in July month-over-month (i.e. compared to June.) This was higher than the 0.7% that experts were expecting. There isn't a 1-to-1 correlation, but producer prices tend to lead consumer prices (see below for shelter), so this may slow or start to put a brake on the decline seen since CPI peaked at 9.1% year-over-year in June 2022, which would, in turn, affect the interest rate outlook from the Federal Reserve, the US central bank. (That said, producer prices that year peaked at 9.8% in July.)

..... ▷ Sam Bankman-Jailed: Meanwhile, FTX Co-Founder Sam Bankman-Fried was taken into custody after a federal judge revoked his $250mn bail less than two months before his scheduled fraud trial. The judge issued the order in Manhattan on Friday afternoon, and Bankman-Fried was immediately placed in handcuffs as marshals escorted him out of the courtroom. Prosecutors said SBF, who has been charged with fraud and money laundering (see recap here), had tried to tamper with witnesses, including by leaking the private diaries of former girlfriend, Sultry Wood Nymph and CEO of FTX sister company Alameda Research Caroline Ellison to discredit her in the eyes of potential jurors since she's expected to testify against him. According to the prosecutors, SBF had “over 1,000 phone calls with members of the media” over the past few months.

Emily Blunt playing the CEO of Alameda Research in a dramatic reenactment.

- Image credit: My Summer of Love (2004) / ContentFilm via Tenor

..... ▷ Good is Bad in the UK: Britain's economy unexpectedly grew by 0.2% in Q2, against an average expert forecast of 0.0%, which all but confirms continued Bank of England rate hikes, sending yields on Gilts (UK sovereign bonds) and the Pound up... though some of the gain was from an extra holiday in May. But according to the Office for National Statistics (ONS), UK GDP in the second quarter was still 0.2% lower than in the same quarter of 2019. This leaves it the sole major advanced economy yet to reach pre-COVID levels, lagging behind Germany at +0.2%, France +1.7%, Italy +2.2%, and the US +6.2% over the same period.

Helped UK GDP growth stay positive for a quarter

- Image credit: Ottr Dan via Unsplash

Gimme CPI Shelter

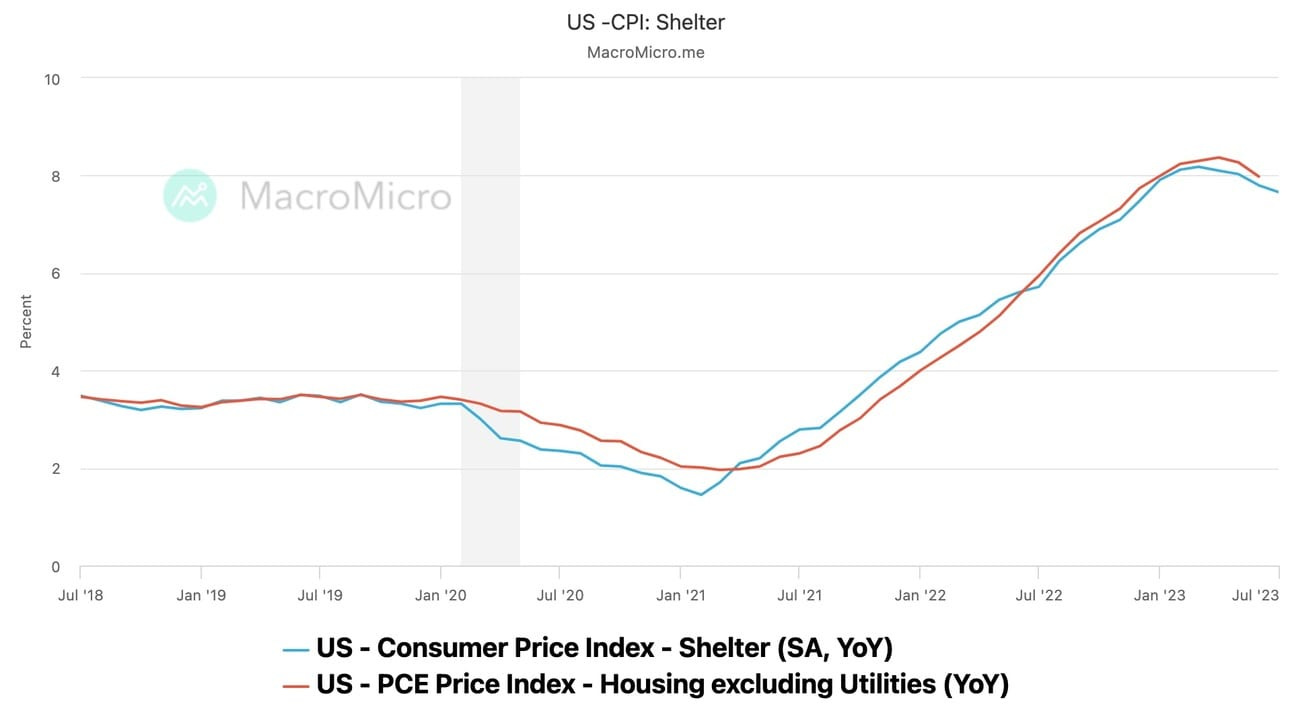

The shelter component of the US consumer price index (CPI) came in at 7.7% in July, off its peak of 8.2% in March, but still way higher than the overall CPI. According to the US Bureau of Labor Statistics, which compiles the CPI, shelter inflation accounted for 90.3% of the increase in the CPI in July 2023, by far the single biggest driver of inflation. Luckily, the Federal Reserve Bank of SF expects shelter inflation to slow significantly over the next 18 months, based on the effect of interest rate hikes on house prices and rents.

..... ▷ The weighting ("relative importance") of shelter was 35% of the CPI, but of that, 26% is "Owner's Equivalent Rent" (with the balance from actual rent plus a bit from hotels.) The OER refers to the amount of rent that a homeowner would be paid if they were renting out their own home in the market, based on a survey of homeowners, though (critics like the NY Fed contend) it does not reflect the actual cost of owning a home, which includes property taxes, insurance, and maintenance.

"Owners’ Equivalent Rent is a fantasy price no one pays. It is loosely linked to market rents—with a lag—and so is expected to be disinflationary later this year but is currently adding to inflation."

Paul Donovan, UBS Wealth Chief Economist in February 2023 (with OER weighted at more than a quarter of the entire CPI!)

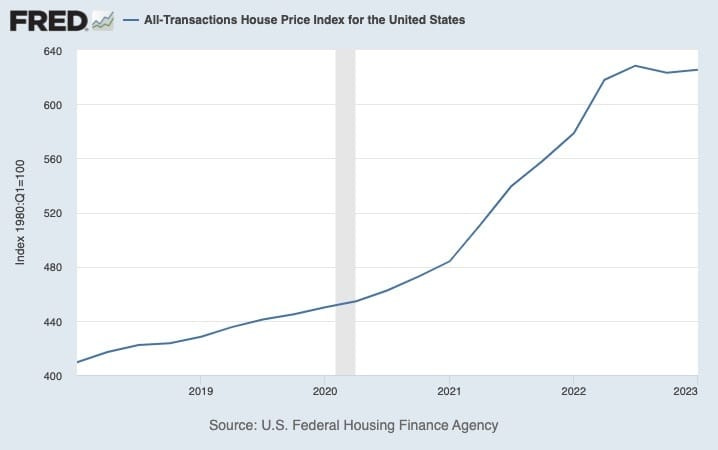

..... ▷ The index for OER alone was up 5.6% from a year ago. Both OER and actual rent are driven (with a lag) by housing prices, which have flattened out in the US for about a year, which means that the effect will start to drop off the year-over-year comparisons. (According to Redfin, home prices nationwide were down 0.83% year-over-year in June.)

Shelter, a huge driver of current CPI inflation, is rolling over, having peaked in March- Image credit MacroMicro.me

And with the flattening out of US home prices since mid-2022, the year-over-year increases in the OER part of CPI should drop away.

- Image credit: The Federal Reserve Bank of St. Louis

📖 MoneyFitt Explains

🎓 Insolvency vs Bankruptcy

Insolvency and bankruptcy are related concepts, but they have distinct meanings:

- Insolvency: Insolvency refers to a financial state where an individual, company, or organisation is unable to meet its financial obligations, such as paying debts when they are due. It's essentially a situation where your liabilities (debts) outweigh your assets (what you own). Insolvency can be a temporary or ongoing condition, and it may or may not lead to bankruptcy.

- Bankruptcy: Bankruptcy is a legal process that comes into play when a person or entity is unable to pay its debts and seeks legal protection from its creditors. It is a formal declaration of financial insolvency. Bankruptcy involves a court proceeding where a person or entity's financial affairs are assessed, and a plan is developed to manage or discharge their debts. Bankruptcy provides a structured way to address insolvency, and it may result in the discharge (cancellation) of some or all of the debts, allowing the person or entity to get a fresh start financially.

In essence, insolvency describes a financial condition, while bankruptcy is a legal process used to address and resolve that condition.

Share The MoneyFitt Morning

{{rp_personalized_text}}

Or copy and paste this link to others: {{rp_refer_url_no_params}}