☀️☕️ Google's Secret Sauce (there isn't any)

📊 Also: Disinflation is still inflation, First Citizens, UBS & CS 🎓 "The Innovator's Dilemma"

Happy Thursday!

📝 Focus

Google's Secret Sauce (there isn't any)

📊 In the Markets

Disinflation is still inflation, First Citizens, UBS & CS

📖 MoneyFitt Explains

🎓️ “The Innovator's Dilemma"

📝 Focus

Google's Secret Sauce (there isn't any)

Under immense pressure from ChatGPT and Microsoft's GPT4-powered version of Bing and Office365, Google is rolling out more and more obvious artificial intelligence for its products, including its core search engine. The Search Generative Experience can generate responses to open-ended queries while, like Bing, still providing a lucrative list of links to the Web. (And, like Bing, there will be a waitlist for it, starting in the US.)

..... ▷ Microsoft-backed OpenAI's sensational launch of ChatGPT in November last year kicked off a furious race among tech giants and startups alike in providing or integrating generative AI productivity tools ("co-pilots") as well as "brand new" fully formed content in text, images, music, software code and ultra weird video. Is every business in the world assessing or already using these options? (We are!) With Bing and ChatGPT’s plausible answers in natural language, Google's long dominance of the $286bn search market became under threat for the first time in a generation (see MFM on the "Innovator's Dilemma" 🎓), cue The MFM’s second-favourite quote again:

“There is such margin in search, which for us is incremental. For Google it's not, they have to defend it all... From now on, the [gross margin] of search is going to drop forever"

Satya Nadella, CEO of Microsoft, adding that the competition with Google was “asymmetric"

..... ▷ Launching it all at Alphabet's annual I/O developer conference, CEO Sundar Pichai said “we are taking the next step with a bold and responsible approach,” while VP Cathy Edwards said ads will remain key... "We only get paid when there's a click." However, she seemed to lose the plot shortly afterwards: “We don’t think users want to be told by an AI what the answer is.”

..... ▷ But just a week earlier, a leaked internal Google memo said “We Have No Moat And Neither Does OpenAI”… Google has no “secret sauce”, particularly with the steady pipeline of its AI engineers out to the competition. More details on this below (from Bing), but it's focused on how quickly the open source community is already able to do almost everything the tech giants can, but, by iterating, they are doing it much (much) faster and much (much much) more cheaply. A large language model known as LLaMA created by Meta was leaked in February, jump-starting progress on generative AI in open-source forums.

..... ▷ For the tech giants, the battle between them will be about brand, integration into existing offerings (like Copilot in Office365, Google Maps, Docs and Gmail) and monetisation... and possibly who swallows up the best open source offerings. (The memo writer suggested collaborations.) But the threat of an unexpected, massive new disruptor out of left field can't be entirely dismissed.

It's the fast-moving little guys who could be the winners

- Image credit: Stable Diffusion, which only launched Aug-22 but, thanks to its lack of use restrictions, has displaced pioneer OpenAI's DALL-E, launched in Jan-21

The leaked internal memo was confirmed written by a senior Google software engineer in early April 2023. This is Bing's 5 bullet point summary of the memo:

▷ The memo argues that Google and OpenAI are losing the AI arms race to the open-source community, where independent researchers are making rapid and unexpected advances in generative AI models.

▷ The memo claims that Google's AI models are slower, more expensive, less customizable, and less capable than the open-source alternatives, which can achieve comparable or better quality with less resources and time.

▷ The memo warns that Google has no secret sauce or moat in AI, and that its best hope is to learn from and collaborate with the open-source community.

▷ The memo suggests that Google should prioritize enabling third-party integrations, consider where its value add really is, and focus on solving real-world problems rather than chasing milestones.

▷ The memo cites several examples of open-source models that outperform or challenge Google's models, such as Stable Diffusion, ChatGPT, Midjourney, KARLO, and CLIP.

Meanwhile, yesterday's MFM Focus about Nintendo included scathing Bing-generated "reviews" of the new Super Mario movie that were entirely hallucinogenic. Lesson learned about double-checking generative AI output. We apologise.

If you are enjoying The MoneyFitt Morning and would like to continue learning what's important in investing & business, please subscribe!

📊 In the Markets

US inflation data came in slightly weaker than expected, boosting traders' hopes that the US central bank, the Federal Reserve, would soon halt its campaign of interest rate hikes. US government bonds, called Treasuries, rallied but stocks were mixed into the close.

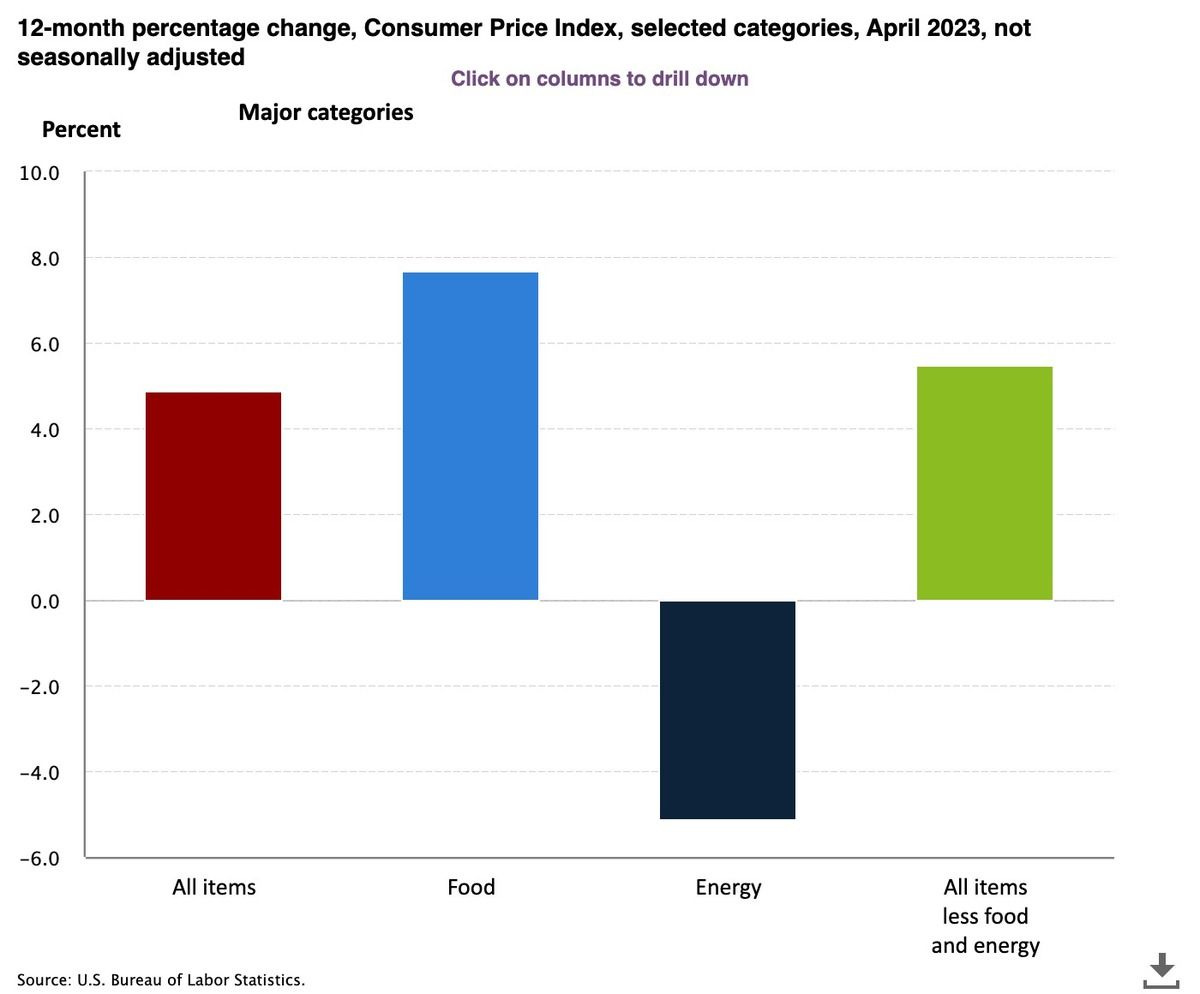

Disinflation is still inflation: US prices, measured by the Consumer Price Index, were still rising in April, but at an annual rate of 4.9%, but more slowly (this is known as "disinflation.") It's now at the lowest it's been in two years and even slightly below forecasts of 5%. Compared to March, prices rose 0.4%, pushed higher by rising shelter, used car and petrol prices. (Core inflation, which excludes volatile food and energy prices, dipped a bit to 5.5% from 5.6%.) The Fed actually prefers to follow the Department of Commerce's PCE calculation of inflation, which comes out 3 weeks after the more widely followed CPI. (The PCE includes a wider range of goods and services, including employee benefits, and has more rural data.)

..... ▷ Inflation is far below the 9% peak in June 2022 but still well above the Fed’s 2% target. After 10 consecutive months of slowing headline consumer prices, investors are hoping that last week's Fed hike would be its last, with US interest rates now at the highest level since mid-2007. Based on futures prices, investors are pricing in almost an 80% chance of a rate cut in September, and rates this time next year are expected to be about 1.5% lower than where we are today (according to the CME FedWatch Tool.)

- Image credit: The US Department of Labor

Rewards for Rescuers: First Citizens Bank, the bank that bought much of Silicon Valley Bank from regulators after its sudden collapse, booked massive first-quarter profit growth of 30 times what it made the previous year, powered by a $9.8bn gain from its deal for SVB. Without it, earnings growth would have been more or less flat.

..... ▷ Skipping back across the pond, this is about the same happy situation that Swiss banking giant UBS is facing. After taking over Credit Suisse, its cross-square archrival, UBS is going to record the BIGGEST BANKING PROFIT EVER. Because of the rock-bottom price it negotiated with authorities in the rescue, an accounting gain known as "negative goodwill" will generate a profit of up to $57 BILLION in the quarter it is booked. This is based on the difference between what it paid, $3.25bn, and the $60bn book value of Credit Suisse.

The rescuers' giant profits come directly from the pockets of rescued bank shareholders

- Image credit: It's Always Sunny in Philadelphia / 20th Television, Disney ABC via Tenor

📖 MoneyFitt Explains

🎓️ “The Innovator's Dilemma"

"The Innovator's Dilemma" is a concept in which established, incumbent companies decline because they fail to adopt new technologies or business models which new and more nimble competitors are deploying to disrupt their business since their established products and processes are too profitable to give up.

- Example 1: Kodak and the shift from film to digital photography. Kodak was slow to embrace digital photography, due to its dominance in the film photography market and concerns about cannibalizing its own sales.

- Example 2: Blockbuster and the rise of online video streaming (i.e. Netflix). Blockbuster was hesitant to embrace online video streaming services, as it would mean giving up their brick-and-mortar rental model, which was highly profitable at the time.

It is a useful way to think of the potential future decline of currently highly successful companies, though it can oversimplify the complex economic and organizational factors that play a role in a company's decision-making, focusing too much on technological disruption as the main challenge facing companies.

(Harvard Business School professor Clayton Christensen conceptualised disruptive innovation in his 1997 book, "The Innovator's Dilemma")