☀️☕️ Interest in Apple... Savings!

📊 Also: Bing on Samsung? Google panic levels go up a notch; HSBC, Porsche 🎓 Return on equity

Happy Tuesday!

📝 Focus

Interest in Apple... Savings!

📊 In the Markets

Bing on Samsung? Google panic level up a notch (Samsung, Microsoft, Google)

HSBC, Porsche

📖 MoneyFitt Explains

🎓️ ROE ROE ROE your boat (return on equity)

📝 Focus

Interest in Apple... Savings!

Apple and Goldman Sachs launched a new savings account paying 4.15% interest, more than 10X what US banks are paying, which averages just 0.37%. It's even more than the 3.9% that Goldman is paying on its Marcus account! And because Goldman Sachs provides the underlying banking licence, it's insured by the FDIC up to US$250,000 per account. It's being offered to Apple's credit card customers first, which is also a partnership with GS, and broadens Apple’s financial services offerings (which recently added a buy now, pay later.)

Depositors reacting to 4.15% interest rates from a brand they actually trust (with FDIC support) - Image credit: MORE & MORE / Twice via Tenor

..... ▷ So is Apple becoming a bank? No. Why in the world would they want such volatile and puny, highly regulated returns? Already the largest company in the world by market capitalisation at US$2.6 trillion (next is Microsoft at $2.1tn), it's over 6X bigger than JP Morgan Chase, the biggest bank in the world by far. More importantly, its return on equity (ROE) 🎓, the earnings it makes per dollar of shareholder money invested, is off the charts compared to what banks make. JPM made 14% in the last 12 months, and that's very good! Both Citi and Wells Fargo made 7.6% and Credit Suisse made -16% (OK, not fair.) But another good bank, DBS of Singapore, made 14.3%, while SMFG of Japan made 5.3%, and Lloyds topped UK high street banks with 11%.

..... ▷ In comparison, Apple made an ROE of 148%. Goldman (ROE 9.9%) can have that business... Apple will use it to generate more profitable revenues, just as they have with the Apple Card. (Massive profits from its hardware and, increasingly, services, have meant it could plough back earnings into share buybacks --reducing the number of shares-- worth $550bn in the last decade. That's a third more than JPM is worth now.)

..... ▷ As if things weren’t bad enough for the banking sector already! Deposits have already been flooding out to the very biggest ("too big to fail") banks and to money market funds. Customers have yanked deposits of $800bn from US commercial banks since the Fed started hiking rates in the last year. And it serves them right, considering the playbook actually IS for banks globally to pay less to depositors than what they charge borrowers when interest rates go up, and to drop them faster when interest rates go down. See Focus story in this February MFM, in which the CEO of Barclays UK says "they don't necessarily have the confidence to figure out what the right option for them is." Well, say hello to Apple (US for now) and Money Market Funds.

..... ▷ Recent bank results have shown big US financials Charles Schwab, State Street and M&T lost $60bn in combined bank deposit outflows in the first quarter alone as customers had the confidence to move their money to whoever would pay higher returns and who would not go under. (Schwab, a broker/bank said its deposits fell $40bn, or 11%, but saw its money market funds increase by $80bn.)

If you are enjoying The MoneyFitt Morning and would like to continue learning what's important in investing & business, please subscribe!

📊 In the Markets

Markets generally drifted higher as traders pored through the latest bunch of corporate earnings and tried to figure out if there will be a recession, and if so, if company earnings will collapse, and whether the Fed will ride to the rescue or exacerbate it. In yet another sign that the luxury sector is on a different planet from the rest of us, Porsche posted record Q1 sales rise boosted by a 21% post-Zero-Covid leap in sales in China, its largest market and a quarter of its global sales. (Peer Merc only squeezed out a 3% increase there.)

Elsewhere, the largest HSBC shareholder Ping An Insurance of China announced that it will vote to break up the bank at the next annual meeting, spinning off the far less profitable non-Asian businesses into a separate entity.

..... ▷ Not surprisingly, other big HSBC investors, especially those benchmarked to the UK, aren't keen on being stuck with the leftover bits.

"All the c**p that was left over went into what you see in the mirror every morning.” - Image credit: Twins (1988) / Universal via Tenor

Bing on Samsung? Google panic levels go up a notch

Alphabet, the parent of Google, fell 2.8% as The New York Times reported that Samsung is considering making Microsoft’s Bing the default search engine on all its phones. Bing, no readers will need reminding, uses Microsoft-backed OpenAI’s ChatGPT technology, which has sent Google into panic mode multiple times since its viral launch last November. Search was worth $162 billion to Google last year.

Bing Inside? - Image credit: Samsung via Tenor

..... ▷ According to the NYT, when news of Samsung's potential move made it to Google, the reaction was “panic,” according to internal messages, given an estimated $3bn in annual revenue at stake with the Samsung contract. This compares with $20bn in a similar contract with Apple that's up for renewal this year. With a viable (maybe not as good, at the moment, but definitely more interesting) competitor out there pretty much for the first time, Google may of course still keep the business but at a much lower price. Here comes that quote again:

“There is such margin in search, which for us is incremental. For Google it's not, they have to defend it all... From now on, the [gross margin] of search is going to drop forever"

Satya Nadella, CEO of Microsoft, adding that the competition with Google was “asymmetric"

..... ▷ In the 4th quarter of last year, South Korea's Samsung made up 19% of global smartphone shipments, ranking behind Apple at 23% and ahead of China's Xiaomi and OPPO at 10% and 11% respectively (broadly the same as in 4Q21.) For Android phones, Samsung’s market share is around 27% for the first quarter of 2023. Over ONE BILLION people worldwide currently use Samsung smartphones in 2023 according to BankMyCell - just fractionally fewer than the number of Apple iPhone users.

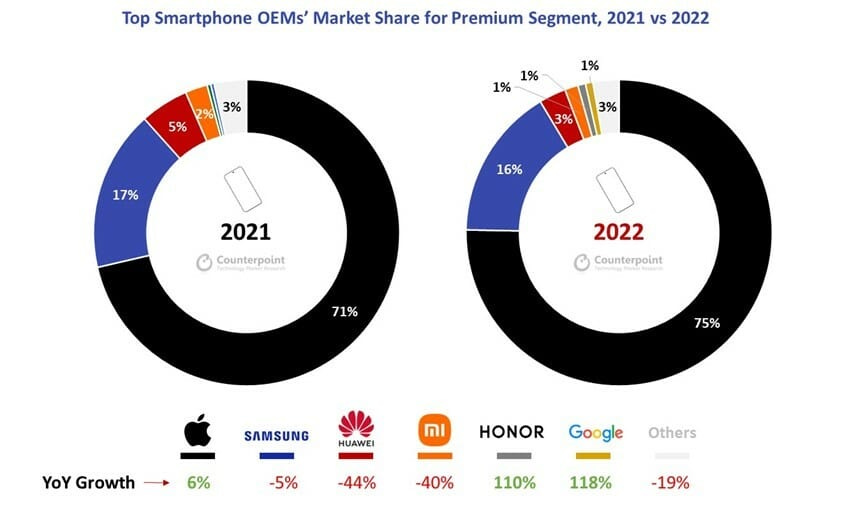

..... ▷ More importantly, the premium segment (US$600 and above) made up over half of smartphone sales last year for the first time. While Apple dominates that space, the clear runner-up in that segment is Samsung, with its Galaxy range, including the imperfect but desirable, fancy, folding, flipping ones that launched in 2019. And of course, premium smartphone buyers are of enormously greater value to Google’s search advertisers than non-premium buyers!

Image credit: Counterpoint research

Oh yes, and nine more US states are joining in with a federal lawsuit against Google over ad tech. Just what it needs right now.

📖 MoneyFitt Explains

🎓️ Return on Equity (ROE)

Return on equity (ROE) is a financial ratio that measures a company's profitability and is expressed as a percentage, net income divided by shareholders' equity (the equity invested by shareholders in the company, not what a buyer pays in the market.)

Higher ROE values can indicate better performance and efficiency in generating profits and is most useful for comparing the performance of companies in the same industry.

Strengths of ROE include its simplicity and ability to capture a company's overall profitability, which is offset against its sensitivity to accounting practices and its failure to consider the cost of debt financing (especially across different industries.) Other measures of returns include return on assets (ROA) and return on investment (ROI).

NERD ALERT: The measure that incorporates the cost of debt better than ROE is Return on Capital Employed (ROCE) which includes both equity and debt financing for a more comprehensive measure of profitability and efficiency. You divide earnings before interest and taxes (EBIT) by the sum of shareholders' equity and debt to show how well a company uses all its capital. DOUBLE ALERT: By comparing ROCE with Weighted Average Cost of Capital (WACC), you can see if the company is generating returns that exceed the cost of financing those investments.