☀️☕️ “Non-Banks” to blow up the world next?

📊 Also: Tesla Loses California Share, Price Hike, Lithium; 🎓 Non-Banks and Shadow Banks

Happy Monday!

Programming note - the MFM will be off tomorrow and back on Wednesday!

📝 Focus

“Non-Banks” to blow up the world next?

📊 In the Markets

Tesla Loses California Share, Price Hike, Lithium

Bed Bath & Afterlife, P&G Charmin

📖 MoneyFitt Explains

🎓️ Non-Banks and Shadow Banks

📝 Focus

Non-banks

"Shadow Banks" and other Non-Bank Financial Institutions 🎓 are facing tougher rules! Led by Janet Yellen's Treasury Department, key US regulators are toughening the financial oversight of non-banks such as investment managers (including hedge funds and private equity investors), insurers and lending marketplace platforms. The Financial Stability Oversight Council will be able to single out individual entities for closer scrutiny by the Fed. However, it may be politically and legally tricky to pass as it would need to reverse Trump-era changes in 2019, making such designations more difficult (and taking up to 6 years!)

..... ▷ The focus is on the risk of one of them blowing up and threatening US financial stability thanks to "the nature, scope, size, scale, concentration, interconnectedness, or mix of the activities of the company.” Financial sector trade bodies are already pushing back at the higher costs that would be involved for companies identified for closer scrutiny.

..... ▷ Obviously, this all comes about following the twin March collapses of SVB and Signature, which led to the worst banking turbulence since the GFC 15 years ago, and which, to prevent contagion, led US authorities to rescue uninsured depositors and roll out an emergency lending facility. But even before that happened, the UK had given the world a sneak preview of the systemic chaos that non-banks can wreak: Right after a disastrous "mini-budget" sent gilt (UK sovereign bond) prices down, pension funds that borrowed money using gilts as collateral to buy more gilts had to find cash to repay their loans, forcing them to sell more gilts, driving down gilt prices further into a spiral, threatening their solvency -- until the central bank intervened to break the cycle. (See MFM on the LDI debacle here.) And non-banks are more significant than ever.

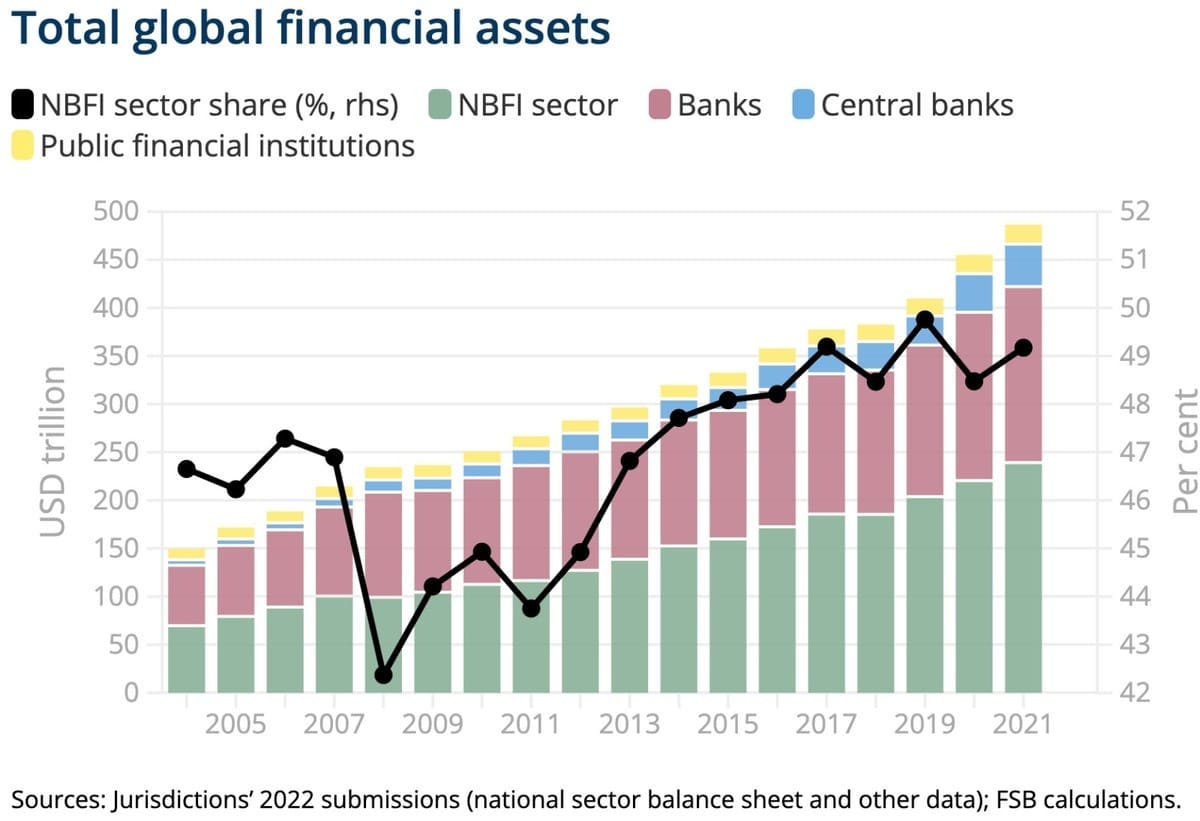

Image credit: FSB.org

The total NBFI sector has been increasing its share and in 2021 hit 49.2%, mainly driven by investment funds, particularly equity funds

..... ▷ The next shoe to drop through the floor is potentially the $20 trillion US commercial real estate market, which is not only heavily lent to by banks (smaller and regional ones in the US, often the same banks that were under the gun post-SVB) but also largely owned by non-banks such as REITs and other investment vehicles. In fact, the world's largest owner of commercial real estate is private equity giant Blackstone through the funds it manages, with a $577 billion portfolio and $326 billion in investor capital. Office and retail property valuations have been falling with lower occupancies partly driven by WFH practices carried over from the pandemic amid higher interest rates. Average occupancy of US offices is still less than half that in March 2020.

““When the Federal Reserve hits the brakes, something goes through the windshield... Commercial real estate is an area of concern. We have higher interest rates for property developers, how does that impact the real estate market and lenders in that space?”

George Gatch, CEO of JPMorgan Asset Management

- Image credit: Hitman's Bodyguard / Netflix via Tenor

..... ▷ More recently, short-sellers have raised their bets against commercial landlords, with real estate now THE most shorted industry globally, according to S&P. (The ECB is particularly worried about “a liquidity mismatch” where REIT owners can sell, forcing managers to then sell the underlying real estate, which could spark a downward spiral taking down banks that lend to them.)

If you are enjoying The MoneyFitt Morning and would like to continue learning what's important in investing & business, please subscribe!

📊 In the Markets

Limited market action on Friday in the US markets after a soft session the day before, as both earnings results and economic data continued to come in mixed, particularly with the earnings calendar packed this week, with heavyweights reporting in every sector. About 1/3rd of the companies in the S&P500 are due to hand in their report cards, including Coca-Cola, Microsoft, Alphabet (Google), Altria, Amazon and Credit Suisse.

..... ▷ Popular 2021 meme stock and struggling home goods retailer Bed Bath & Beyond finally filed for Chapter 11 bankruptcy protection after several last-ditch efforts to raise enough money to keep the company alive failed. Formerly a "category killer", it had been warning of a potential bankruptcy since early January but had been limping along on life support for years, having failed to address the threat of online shopping.

..... ▷ Led by a 10% price hike for the second consecutive quarter, Procter & Gamble widened its gross profit margin to 48%, its highest in 2 years, showing the power of brands and revealing one of the key drivers of inflation this year: profit margin expansion... despite "warning" of higher commodities and packaging costs. The maker of products like Tide detergent, Gillette razors, Head & Shoulders shampoo and Crest toothpaste also grew market share in the US and lifted its sales forecasts, Charmin traders on Friday, which bought it up 3.5%.

Tesla Loses California. Share, Price Hike, Lithium

Tesla's dominance of the US electric vehicle market could be looking shaky, with Reuters reporting that it is losing market share in California, the country's biggest state for zero-emission vehicles, coming in at 60% in the first quarter, compared to 73% a year earlier. Coming after launching an aggressive global EV price war (with the sixth consecutive cut just last week,) this may reflect Tesla's weakening positioning against smaller rivals such as VW, GM's Chevrolet unit and Kia. (Sales in California alone made up 16% of Tesla's global 2022 deliveries.)

..... ▷ But this may not entirely reflect Tesla's performance across the country as liberal states like California could be reacting as much to CEO Elon Musk's erratic-seeming management of new toy Twitter and increasingly high-profile views which many feel are much more conservative than expected. Ironically, traditionally conservative states have been less supportive of electric vehicles to start with, so an interesting brand dynamic is brewing.

..... ▷ Meanwhile, Tesla announced that, in the midst of its price war, it would be hiking US prices by 2-3% for its premium Model S and X cars, though that would still only bring it up to a level that's 20% lower than at the end of 2022 (though the high-performance Plaid version will be marginally above where they were a year ago -- but with three years of free access to its Superchargers.)

..... ▷ Elsewhere in the EV space, on the battery side, Chile has moved to increase state control over its lithium industry, a key raw material. Chile has the world's largest metal reserves and is the world's second-largest producer. It's not like the "nationalisations" of old where foreign or privately owned assets were forcibly acquired, but a move to ensure that the state would hold a controlling interest in all projects through a public company that would partner with private mining firms. Chile would not unilaterally cancel existing contracts. This poses a new risk to EV manufacturers, with more "Resource Nationalism" on the rise, e.g. Mexico (nationalised lithium deposits in 2022) and Indonesia (banned exports of nickel ore, another key battery material, in 2020.) What is happening is fairly common in the oil and gas industry, though there are multiple models of such public-private partnerships.

📖 MoneyFitt Explains

🎓️ Non-bank financial institutions / Shadow Banks

Non-bank financial institutions are entities that provide financial services without holding a banking licence and provide alternative sources of financing.

The main difference is the use of customer deposits. Banks rely heavily on this as a source of funding for their lending and investment activities, but non-banks typically do not, instead raising capital through other means such as issuing bonds, selling securities, raising equity capital from private investors or obtaining financing from other institutions.

Like licensed banks, "non-banks" are subject to regulation and oversight to ensure financial stability and consumer protection, though it's generally less stringent. Examples include insurance companies, investment firms, hedge funds, private equity firms, pension funds, mortgage companies, P2P or marketplace lenders and microfinance institutions.

The dodgy-sounding term "shadow banking" is sometimes used interchangeably, but not all non-banks are shadow banks. They do activities similar to traditional banking services but outside the regulatory framework, including a) Financing through securitisation, loan origination, and (some) subprime lending, b) Market-making and trading, including through complex financial instruments and c) Holding and managing financial assets and liabilities, such as through money market funds or special purpose vehicles.

These activities can pose risks to financial stability, particularly if they involve high levels of leverage or interconnectedness with other financial institutions (as they did in the 2008 GFC.) The lack of transparency and oversight in some shadow banking activities can also make it difficult to assess the potential risks to the financial system. Regulators and policymakers have been working to improve the regulatory framework to address these risks.