☀️☕️ Porsche: Luxury Boom on Four Wheels

📊 Also: Fed Hike, Kenvue, Kraft Heinz, Greedflation, PacWest; 🎓 Initial Public Offerings (IPOs)

Happy Thursday! May the Fourth be…

📝 Focus

Porsche: Luxury Boom on Four Wheels

📊 In the Markets

Fed Hike, Kenvue, Kraft Heinz, Greedflation, PacWest

📖 MoneyFitt Explains

🎓️ IPOs - initial public offerings

📝 Focus

Porsche: Luxury Boom on Four Wheels

Luxury carmaker Porsche posted a 25% jump in first-quarter revenues and earnings as sales at the more expensive end of its already expensive sports cars continued to boom (with high margin extras like coloured brake callipers being loaded on) despite economic volatility for the rest of us. Margins were flat, and prices will be hiked 4-8% in the face of continued cost pressures.

..... ▷ Luxury sales continue to boom despite inflation, cost of living pressures and economic uncertainty ahead. At the forefront of the boom, LVMH, the French luxury giant listed in Paris, recently became the first European company to reach a $500bn market valuation (briefly pipping Tesla) on pandemic recovery sales and rising demand in China. More than a quarter of Porsche's first quarter sales were in China, now its most important market.

..... ▷ Porsche's first and so far only all-electric car is the Taycan, which first outsold its iconic flagship 911 in terms of units sold in 2021. The electric Macan SUV is expected to debut in 2024 at a price point 10-15% higher than the current petrol version. The company plans to increase the all-electric vehicle share of its global sales to 80% by 2030, with a balance of internal combustion engines, hybrids and plug-in hybrids. 2030 is the same year it should be "balance-sheet CO₂-neutral" across the entire value chain.

Forget about banks for a minute (other than what you have or don't have in yours) and check out this all-electric Taycan drift. - Image credit: Tenor

..... ▷ Confusingly, this company is "Dr Ing hc F Porsche AG" or just "Porsche AG", ticker: P911, which just had its Initial Public Offering (IPO) 🎓in Sep-22, and NOT "Porsche Automobil Holding SE", ticker: PAH3, which is a mainly family-held holding company. It is now the third largest automaker by market capitalisation (share price X number of shares) after only Tesla and Toyota, and just ahead of China’s BYD. It's also larger than Mercedes, BMW and its former parent, Volkswagen.

If you are enjoying The MoneyFitt Morning and would like to continue learning what's important in investing & business, please subscribe!

📊 In the Markets

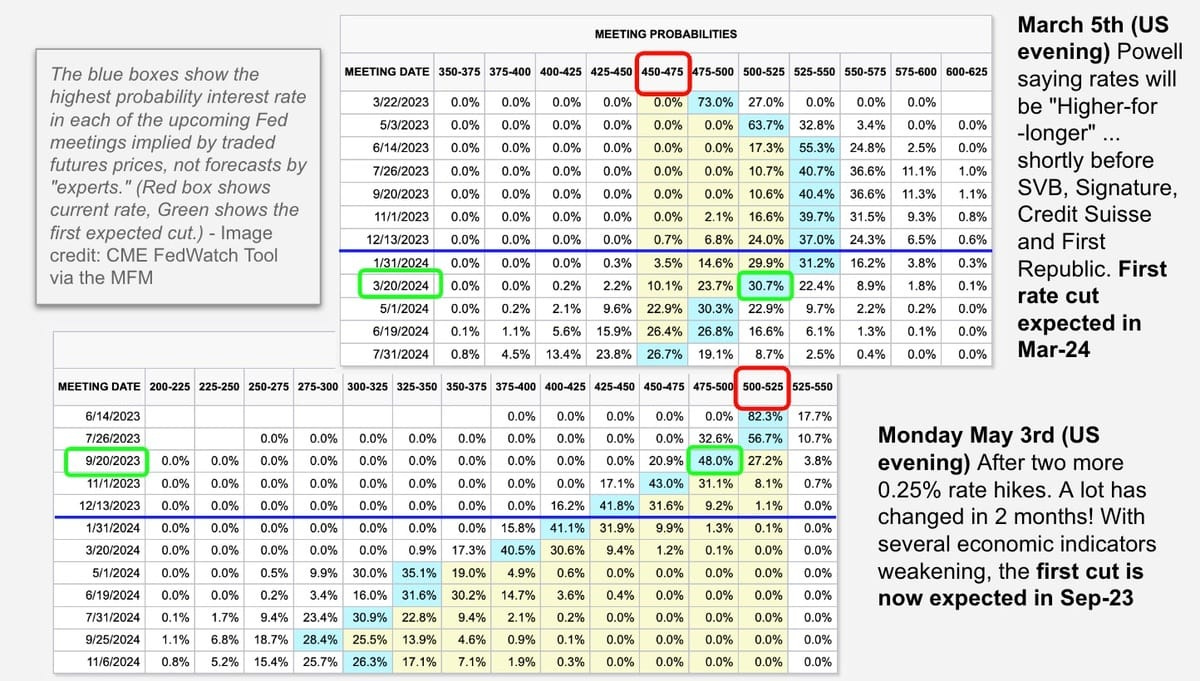

After delivering a widely expected 0.25% interest rate hike, the 10th consecutive in 14 months, Federal Reserve chair Jay Powell disappointed the market by suggesting that the central bank may NOT begin cutting interest rates anytime soon, and that they'd likely have to make do with just a pause.

“The Committee will closely monitor incoming information and assess the implications for monetary policy”

The FOMC statement (replacing: “The Committee anticipates that some additional policy firming may be appropriate” in the previous month)

..... ▷ Stocks had been trading up going into the 2pm formal announcement, but then in the following press conference, Powell said the Fed had "a view that inflation is going to come down not so quickly... if that forecast is broadly right, it would not be appropriate to cut rates.”

..... ▷ Markets are still pricing in a series of cuts this year, though, as the US economy teeters towards a mild recession by the end of the year, with the Fed having to balance stubborn inflation with growing signs of weakness (other than in the labour market and corporate Greedflation profits) along with continued turbulence in the financial sector.

A lot has happened in the last two months - Image credit: CME FedWatch Tool

Kenvue: Johnson & Johnson has priced the Initial Public Offerings (IPO) 🎓 of its consumer-health business, Kenvue Inc (KVUE), at $22 per share, the upper end of its target range, to raise $3.8 billion and value the company at $41bn. After the IPO, JNJ will continue to own 91% of its new spinoff, the largest such spinoff since Altria’s of Philip Morris in 2008. The name Kenvue combines “ken”, a Scottish word for knowledge, and “vue”, meaning sight. Kenvue has a portfolio of iconic brands, such as Tylenol, Neutrogena and Band-Aid.

- Image credit: Kenvue

..... ▷ The original range was for a price of between $20 and $23 per share, so coming in with demand at $22 is pretty decent, but the word to look for in an IPO is "upsize"... the original plan was to sell 151 million shares, but they ended up “upsizing” the deal to 173 million. Maths: The company raised $330 million more by giving hungry and hopefully happy investors more shares at a lower price than if they'd gone with the original number of shares at the top of the range.

Kraft Heinz: In yet another apparent example of corporate Greedflation, the maker of Heinz Ketchup and Kraft Macaroni and Cheese raised its guidance for the year after reporting first quarter earnings up 13% on a 7% increase in sales, on a near 15% increase in prices from a year ago. (See below!) Wall Street's Finest's forecasts were 12% below where the company actually delivered. Kraft Heinz was formed when Kraft, a corporate spinoff from Altria (see above), merged in 2015 with Heinz.

..... ▷ More on Food prices: The price of cheese, milk and eggs in the UK rose more than 30% in the 12 months to March, within which the price of hard cheese rose the fastest at 44%. In just one year. Egg and milk prices rose at three times the headline inflation rate of 10.1% over that period.

PacWest: The Beverly Hills-based bank more than halved in aftermarket trading on Wednesday, sending midsized banking peers Western Alliance down a quarter and Zions Bancorp and Comerica off 10%. Bloomberg reported after the close that PACW had engaged a boutique investment bank and was "exploring strategic options," thinly disguised code for "somebody help me." Just six weeks ago, PacWest announced that it had raised $1.4bn in a loan from an Apollo-backed investment firm.

..... ▷ PACW is one of the top 100 US banks, though a lot smaller than both SVB and First Republic in terms of assets and deposits. But its similarities to SVB made it stand out in the eyes of the short selling and deposit-shifting crowd, particularly its ties to the tech community, a large amount of uninsured deposits, and big paper losses on its securities portfolio. More than three-quarters of its lending is to real estate, with just under 10% to venture capital.

📖 MoneyFitt Explains

🎓️ Initial Public Offerings (IPOs)

An IPO is when a privately owned company sells new shares to the public and institutional investors (including mutual or hedge funds, pensions, banks, insurance companies, trusts and sovereign wealth funds. Main ones in “the book” are called "cornerstone" or "anchor" investors.)

Shares must fulfil certain disclosure and other requirements to get "listed" on a stock exchange where investors can trade them. To help the company through this process, an IPO is "underwritten" by investment banks, who also find buyers for the shares and help set the price.

The main reason for having an IPO is for the company to raise money by selling shares in itself to grow its business. Almost as important, it's a way for existing shareholders and management to sell their shares and receive money themselves. A third reason is to have something tradeable to incentivise staff with.

IPO prices are usually set high enough to raise enough money but low enough for the shares to go up "in the aftermarket" on buying by investors who didn't get as many as they originally wanted. This is reflected in the subscription multiple (the number of shares desired divided by the number on offer.)

Everyone likes IPOs shooting up, especially management, the banks and IPO investors (though, in a way, it means it was underpriced.) There's no guarantee that it will, but banks sometimes legally "support" the share price in the market afterwards.